AI in Private Equity: an Overview of the AI Market Map

AI in Private Equity: an Overview of the AI Market Map

DocuBridge Team

•

Dec 27, 2024

Private Equity’s Transformation with AI: From Challenges to Opportunities

Private equity firms are evolving. Tasks like due diligence, financial modeling, and portfolio management—essential for growth and leadership—often feel like hurdles rather than stepping stones. Endless document reviews, manual data entry, and fragmented insights often are time consuming and delay decisions.

What if these bottlenecks disappeared? In a perfect world, analysts can shift focus from repetitive tasks to crafting high-impact strategies that truly drive results. Artificial Intelligence (AI) tools offer this promise, revolutionizing private equity workflows by eliminating inefficiencies and unlocking potential.

Since early 2024, we’ve spoken to nearly 500 private equity leaders to uncover their priorities. Their key concerns? Too many AI options and uncertainty about what works. “Which tool is right for our firm? How do we implement AI successfully?”

This article breaks down AI’s benefits, addresses the challenges it solves, and outlines actionable strategies for implementation. Our aim is simple: empower you with the clarity to adopt AI effectively.

Key Takeaways

73% of PE firms are transitioning from basic automation to advanced AI solutions, cutting operational costs by 25% and reducing manual data processing time by 40% while improving deal evaluation capacity by 25%.

Analysts currently spend 15-20 hours weekly on manual data extraction due to document processing bottlenecks and fragmented data sources.

AI-powered solutions can reduce processing time by 75%, achieve 99.9% accuracy, and enable firms to evaluate 30% more potential deals in the same timeframe.

Successful AI implementation requires a phased approach, starting with readiness assessment across data infrastructure, technical capabilities, and team expertise, followed by a structured 3-6 month pilot program.

Firms using AI report concrete benefits, including 85% reduction in manual data entry, 3x faster deal screening, 50% improvement in data accuracy, and annual cost savings exceeding $2M for mid-sized firms.

What We Learned: AI’s Impact on Private Equity

AI adoption in private equity is reshaping the industry. Firms are moving beyond basic automation to tailored AI solutions that deliver measurable results. Unlike other tech markets, the AI landscape demands tools that are flexible, customizable, and deeply integrated into existing workflows.

Traditional methods for deal evaluation and analysis, heavily reliant on manual processes, are no longer sustainable. To remain competitive, PE firms are embracing AI to:

Automate time-consuming tasks

Generate actionable insights

Improve the speed and accuracy of decision-making

Limited real-time visibility into portfolio performance

Our research shows that 73% of PE firms are transitioning from basic automation to advanced AI tools. These solutions reduce operational costs by 25%, cut manual data processing by 40%, and increase deal evaluation capacity by 25%.

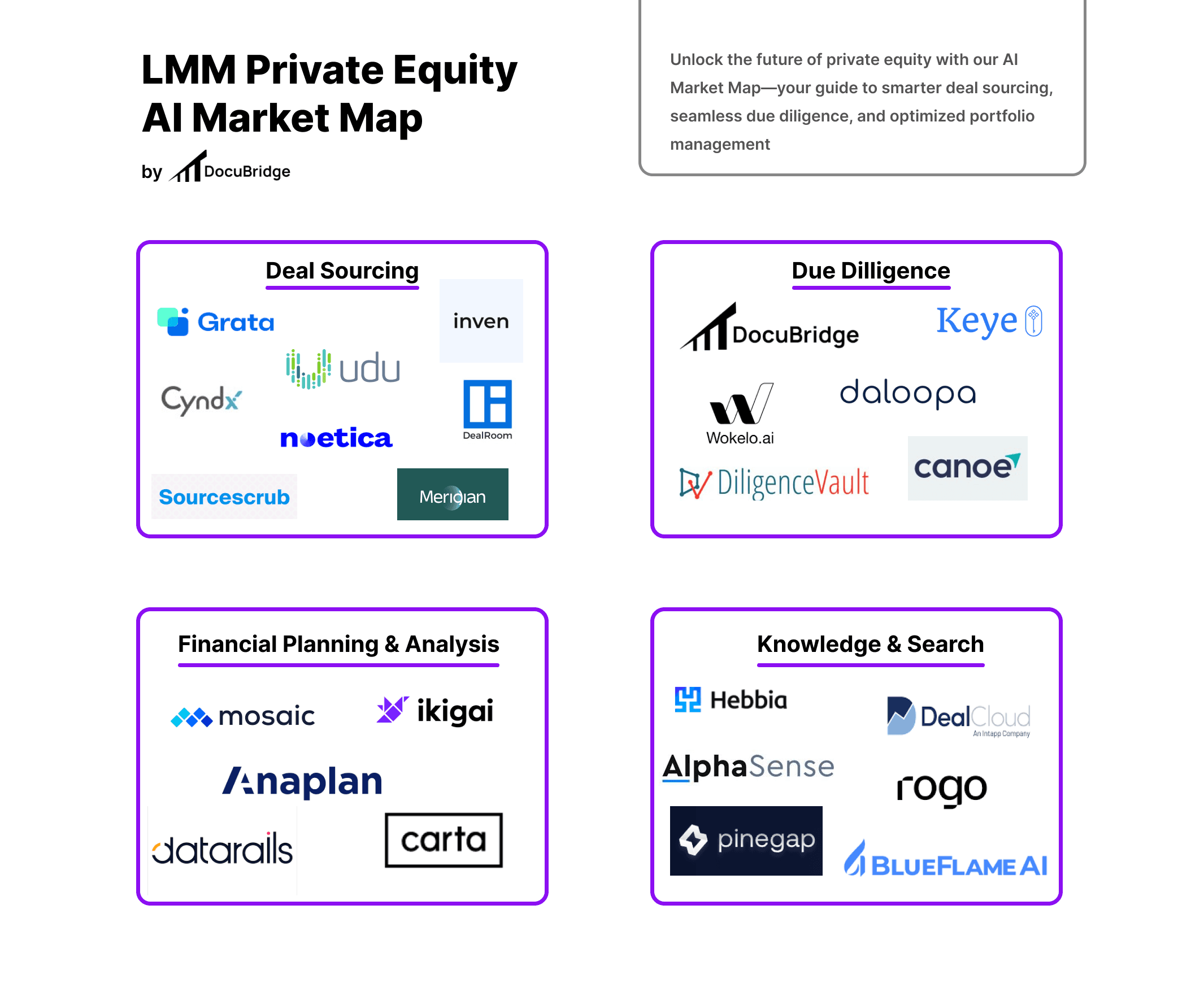

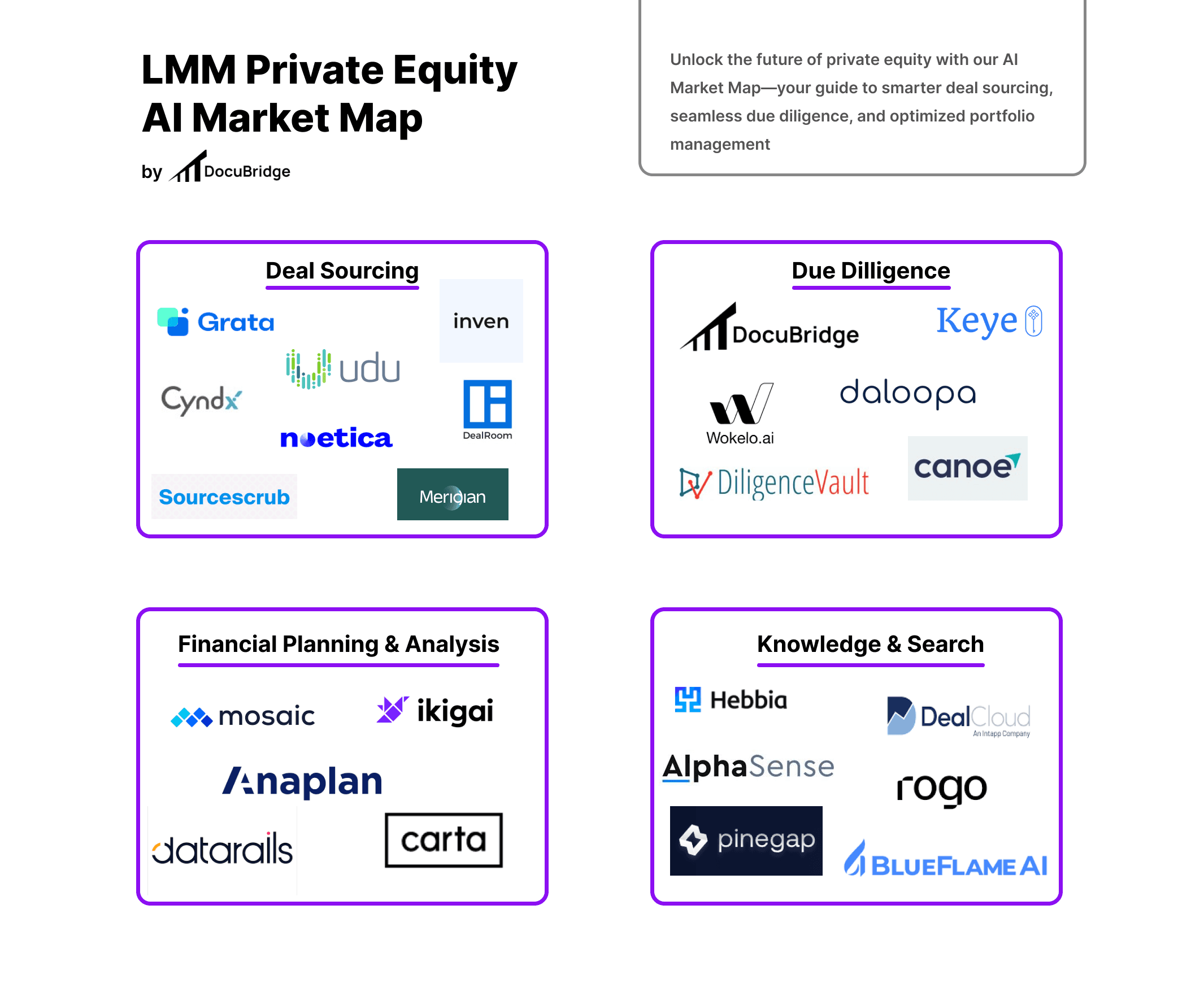

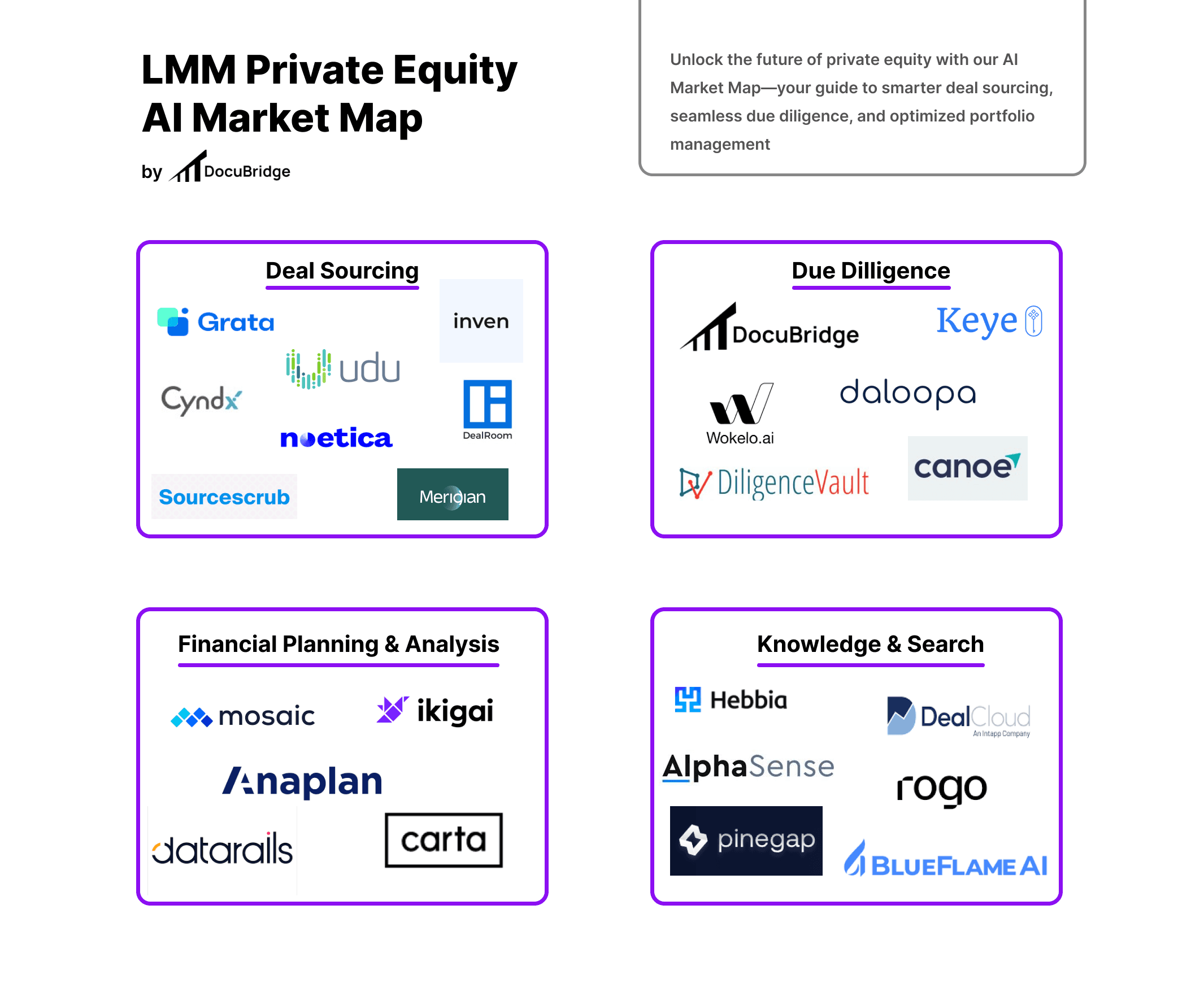

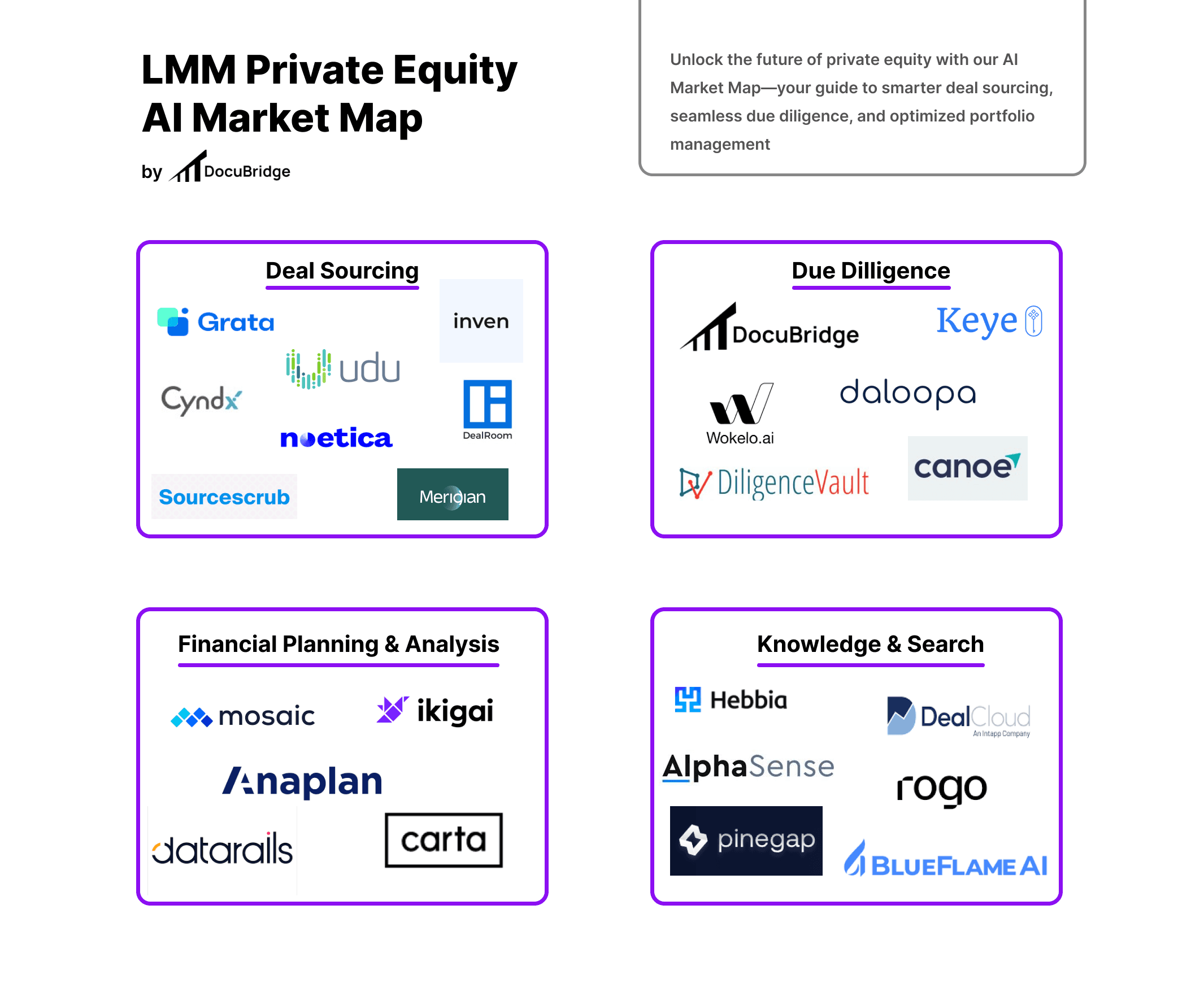

Transforming Workflows: AI’s Role Across Key Processes

AI isn’t just automating workflows; it’s enhancing them. Here’s how AI is driving efficiency across private equity operations:

Deal Sourcing

For many firms, deal sourcing is one of the most critical yet time-intensive parts of the investment process. With predictive analytics, AI identifies opportunities, uncover hidden prospects, and map trends across vast datasets.

Tools like Grata and Cyndx are leading the way. For example, Grata serves as an AI-powered search engine, helping investors discover middle-market companies and reducing time spent on manual prospecting. Similarly, SourceScrub specializes in identifying private companies through a combination of public and proprietary data. By automating these labor-intensive processes, AI tools allow teams to focus on high-quality opportunities that align with their investment theses.

Due Diligence

As any private equity professional knows, due diligence is the backbone of a successful investment. Yet, it often feels like a bottleneck—demanding hours of document analysis, data extraction, and manual checks.

AI-driven platforms are redefining this process. DocuBridge, for instance, automates modeling and accelerates validation of financial data directly within Excel. By transforming unstructured data into actionable insights, DocuBridge accelerates workflows and reduces human error.

Other tools, like Daloopa and Canoe Intelligence, further enhance due diligence. Daloopa automates financial model updates by extracting data from filings, while Canoe Intelligence processes capital call notices, quarterly reports, and other essential documents to streamline analysis. By automating repetitive tasks and providing predictive insights, these solutions enable firms to make smarter decisions faster—without compromising on rigor.

Financial Planning & Analysis

Financial planning is not an exception as AI help automate manual processes and improve forecasting capabilities. Tools like Mosaic and Ikigai combine scenario modeling, real-time reporting, and predictive analytics to support data-driven decisions.

For firms reliant on Excel, platforms like DataRails integrate seamlessly, offering advanced analytics while retaining the familiarity of spreadsheets. Similarly, Anaplan provides cloud-based planning tools that enhance cross-functional collaboration.

These solutions empower firms to optimize portfolio performance and allocate resources strategically.

Knowledge & Search

Staying ahead of market trends and accessing actionable insights are vital for private equity professionals. AI tools are revolutionizing knowledge management by aggregating and analyzing data from diverse sources.

For instance, Hebbia uses AI-powered search capabilities to extract meaningful insights from unstructured data, such as legal filings or market reports. Platforms like AlphaSense and Rogo complement this by aggregating financial trends and research into unified dashboards, streamlining the process of gathering critical information. These tools enable firms to make informed, timely decisions, even when faced with vast amounts of data.

Overcoming Private Equity’s Operational Challenges

Private equity firms face recurring challenges that slow down operations and impact returns. AI directly addresses these pain points:

Document Processing Bottlenecks: Analysts spend 10-20 hours per week, building financial model and conduct analysis manually.

Fragmented Data Sources: Gathering and validating data from multiple systems is inefficient.

Inconsistent Reporting Formats: Varied reporting structures make analysis cumbersome.

Limited Real-Time Insights: Delays in accessing key portfolio performance data hinder agility.

AI solutions improve accuracy to 99.9%, reduce manual workloads, and enable real-time monitoring. Firms using AI report an 85% reduction in manual data entry and 3x faster deal screening.

Strategic Implementation: Setting the Stage for Success

Successfully adopting AI requires more than picking the right tool. A phased and strategic approach ensures long-term results:

Assess Readiness:

Evaluate data infrastructure, technical systems, and team expertise.

Pilot Program (3-6 Months):

Phase 1: System setup (Weeks 1-4)

Phase 2: User training and workflow integration (Weeks 5-8)

Phase 3: Monitoring and optimization (Weeks 9-16)

Measure Success:

Track key metrics such as time savings, error reduction, and user adoption.

Iterate and Scale:

Refine workflows based on feedback and expand adoption across teams.

Firms that conduct thorough readiness assessments are twice as likely to achieve successful AI implementation compared to those that skip this step.

The ROI of AI: Measurable Benefits Across the Lifecycle

When firms integrate AI into their workflows, the results are transformative:

85% reduction in manual data entry

3x faster deal screening

50% improvement in data accuracy

$100k+ annual cost savings for mid-sized firms

One mid-market firm using DocuBridge cut due diligence time by 60% and evaluated 30% more deals in the same timeframe. Another achieved 50% faster quarterly reporting cycles and a 3x increase in portfolio monitoring capacity. Try our ROI Calculator to see how much time and money DocuBridge could save your firm.

Frequently Asked Questions

What are the main benefits of AI adoption in private equity?

AI reduces manual work by up to 60%, improves accuracy, accelerates deal screening, and enhances portfolio monitoring. Firms typically see a 25% reduction in operational costs and evaluate 30% more potential deals in the same timeframe.

How long does AI implementation usually take?

A typical implementation follows a 3-6 month pilot program, broken into three phases: system setup (1-4 weeks), user training (5-8 weeks), and monitoring and optimization (9-16 weeks).

What ROI can firms expect from AI implementation?

Mid-sized firms report annual cost savings exceeding $100k+, with an 85% reduction in manual data entry, 3x faster deal screening, and a 50% improvement in data accuracy.

What should firms assess before implementing AI solutions?

Firms should evaluate three main areas: data infrastructure (quality and accessibility), technical capabilities (existing systems), and team expertise (current skill levels and training needs).

How does AI improve due diligence processes?

AI-powered solutions reduce due diligence processing time by 75% while achieving 99.9% accuracy. These tools automate data extraction from financial statements and validate data across multiple sources.

What are the main challenges in implementing AI solutions?

Common challenges include document processing bottlenecks, fragmented data sources, inconsistent reporting formats, and limited real-time insights. Successful implementation requires addressing these through careful planning and training.

The Path Forward: Unlocking AI’s Potential

Private equity firms that embrace AI are gaining a competitive edge. By addressing operational inefficiencies and empowering teams with better tools, firms can unlock measurable value across every stage of the investment lifecycle.

Ready to see what AI can do for your firm? Contact our CEO Dhruv at dhruv@docubridge.ai to learn more about tailored solutions for your needs.

Private Equity’s Transformation with AI: From Challenges to Opportunities

Private equity firms are evolving. Tasks like due diligence, financial modeling, and portfolio management—essential for growth and leadership—often feel like hurdles rather than stepping stones. Endless document reviews, manual data entry, and fragmented insights often are time consuming and delay decisions.

What if these bottlenecks disappeared? In a perfect world, analysts can shift focus from repetitive tasks to crafting high-impact strategies that truly drive results. Artificial Intelligence (AI) tools offer this promise, revolutionizing private equity workflows by eliminating inefficiencies and unlocking potential.

Since early 2024, we’ve spoken to nearly 500 private equity leaders to uncover their priorities. Their key concerns? Too many AI options and uncertainty about what works. “Which tool is right for our firm? How do we implement AI successfully?”

This article breaks down AI’s benefits, addresses the challenges it solves, and outlines actionable strategies for implementation. Our aim is simple: empower you with the clarity to adopt AI effectively.

Key Takeaways

73% of PE firms are transitioning from basic automation to advanced AI solutions, cutting operational costs by 25% and reducing manual data processing time by 40% while improving deal evaluation capacity by 25%.

Analysts currently spend 15-20 hours weekly on manual data extraction due to document processing bottlenecks and fragmented data sources.

AI-powered solutions can reduce processing time by 75%, achieve 99.9% accuracy, and enable firms to evaluate 30% more potential deals in the same timeframe.

Successful AI implementation requires a phased approach, starting with readiness assessment across data infrastructure, technical capabilities, and team expertise, followed by a structured 3-6 month pilot program.

Firms using AI report concrete benefits, including 85% reduction in manual data entry, 3x faster deal screening, 50% improvement in data accuracy, and annual cost savings exceeding $2M for mid-sized firms.

What We Learned: AI’s Impact on Private Equity

AI adoption in private equity is reshaping the industry. Firms are moving beyond basic automation to tailored AI solutions that deliver measurable results. Unlike other tech markets, the AI landscape demands tools that are flexible, customizable, and deeply integrated into existing workflows.

Traditional methods for deal evaluation and analysis, heavily reliant on manual processes, are no longer sustainable. To remain competitive, PE firms are embracing AI to:

Automate time-consuming tasks

Generate actionable insights

Improve the speed and accuracy of decision-making

Limited real-time visibility into portfolio performance

Our research shows that 73% of PE firms are transitioning from basic automation to advanced AI tools. These solutions reduce operational costs by 25%, cut manual data processing by 40%, and increase deal evaluation capacity by 25%.

Transforming Workflows: AI’s Role Across Key Processes

AI isn’t just automating workflows; it’s enhancing them. Here’s how AI is driving efficiency across private equity operations:

Deal Sourcing

For many firms, deal sourcing is one of the most critical yet time-intensive parts of the investment process. With predictive analytics, AI identifies opportunities, uncover hidden prospects, and map trends across vast datasets.

Tools like Grata and Cyndx are leading the way. For example, Grata serves as an AI-powered search engine, helping investors discover middle-market companies and reducing time spent on manual prospecting. Similarly, SourceScrub specializes in identifying private companies through a combination of public and proprietary data. By automating these labor-intensive processes, AI tools allow teams to focus on high-quality opportunities that align with their investment theses.

Due Diligence

As any private equity professional knows, due diligence is the backbone of a successful investment. Yet, it often feels like a bottleneck—demanding hours of document analysis, data extraction, and manual checks.

AI-driven platforms are redefining this process. DocuBridge, for instance, automates modeling and accelerates validation of financial data directly within Excel. By transforming unstructured data into actionable insights, DocuBridge accelerates workflows and reduces human error.

Other tools, like Daloopa and Canoe Intelligence, further enhance due diligence. Daloopa automates financial model updates by extracting data from filings, while Canoe Intelligence processes capital call notices, quarterly reports, and other essential documents to streamline analysis. By automating repetitive tasks and providing predictive insights, these solutions enable firms to make smarter decisions faster—without compromising on rigor.

Financial Planning & Analysis

Financial planning is not an exception as AI help automate manual processes and improve forecasting capabilities. Tools like Mosaic and Ikigai combine scenario modeling, real-time reporting, and predictive analytics to support data-driven decisions.

For firms reliant on Excel, platforms like DataRails integrate seamlessly, offering advanced analytics while retaining the familiarity of spreadsheets. Similarly, Anaplan provides cloud-based planning tools that enhance cross-functional collaboration.

These solutions empower firms to optimize portfolio performance and allocate resources strategically.

Knowledge & Search

Staying ahead of market trends and accessing actionable insights are vital for private equity professionals. AI tools are revolutionizing knowledge management by aggregating and analyzing data from diverse sources.

For instance, Hebbia uses AI-powered search capabilities to extract meaningful insights from unstructured data, such as legal filings or market reports. Platforms like AlphaSense and Rogo complement this by aggregating financial trends and research into unified dashboards, streamlining the process of gathering critical information. These tools enable firms to make informed, timely decisions, even when faced with vast amounts of data.

Overcoming Private Equity’s Operational Challenges

Private equity firms face recurring challenges that slow down operations and impact returns. AI directly addresses these pain points:

Document Processing Bottlenecks: Analysts spend 10-20 hours per week, building financial model and conduct analysis manually.

Fragmented Data Sources: Gathering and validating data from multiple systems is inefficient.

Inconsistent Reporting Formats: Varied reporting structures make analysis cumbersome.

Limited Real-Time Insights: Delays in accessing key portfolio performance data hinder agility.

AI solutions improve accuracy to 99.9%, reduce manual workloads, and enable real-time monitoring. Firms using AI report an 85% reduction in manual data entry and 3x faster deal screening.

Strategic Implementation: Setting the Stage for Success

Successfully adopting AI requires more than picking the right tool. A phased and strategic approach ensures long-term results:

Assess Readiness:

Evaluate data infrastructure, technical systems, and team expertise.

Pilot Program (3-6 Months):

Phase 1: System setup (Weeks 1-4)

Phase 2: User training and workflow integration (Weeks 5-8)

Phase 3: Monitoring and optimization (Weeks 9-16)

Measure Success:

Track key metrics such as time savings, error reduction, and user adoption.

Iterate and Scale:

Refine workflows based on feedback and expand adoption across teams.

Firms that conduct thorough readiness assessments are twice as likely to achieve successful AI implementation compared to those that skip this step.

The ROI of AI: Measurable Benefits Across the Lifecycle

When firms integrate AI into their workflows, the results are transformative:

85% reduction in manual data entry

3x faster deal screening

50% improvement in data accuracy

$100k+ annual cost savings for mid-sized firms

One mid-market firm using DocuBridge cut due diligence time by 60% and evaluated 30% more deals in the same timeframe. Another achieved 50% faster quarterly reporting cycles and a 3x increase in portfolio monitoring capacity. Try our ROI Calculator to see how much time and money DocuBridge could save your firm.

Frequently Asked Questions

What are the main benefits of AI adoption in private equity?

AI reduces manual work by up to 60%, improves accuracy, accelerates deal screening, and enhances portfolio monitoring. Firms typically see a 25% reduction in operational costs and evaluate 30% more potential deals in the same timeframe.

How long does AI implementation usually take?

A typical implementation follows a 3-6 month pilot program, broken into three phases: system setup (1-4 weeks), user training (5-8 weeks), and monitoring and optimization (9-16 weeks).

What ROI can firms expect from AI implementation?

Mid-sized firms report annual cost savings exceeding $100k+, with an 85% reduction in manual data entry, 3x faster deal screening, and a 50% improvement in data accuracy.

What should firms assess before implementing AI solutions?

Firms should evaluate three main areas: data infrastructure (quality and accessibility), technical capabilities (existing systems), and team expertise (current skill levels and training needs).

How does AI improve due diligence processes?

AI-powered solutions reduce due diligence processing time by 75% while achieving 99.9% accuracy. These tools automate data extraction from financial statements and validate data across multiple sources.

What are the main challenges in implementing AI solutions?

Common challenges include document processing bottlenecks, fragmented data sources, inconsistent reporting formats, and limited real-time insights. Successful implementation requires addressing these through careful planning and training.

The Path Forward: Unlocking AI’s Potential

Private equity firms that embrace AI are gaining a competitive edge. By addressing operational inefficiencies and empowering teams with better tools, firms can unlock measurable value across every stage of the investment lifecycle.

Ready to see what AI can do for your firm? Contact our CEO Dhruv at dhruv@docubridge.ai to learn more about tailored solutions for your needs.